Transform Your Business, Transform Your Life

No more guesswork. No more dependency. Just systems that grow with you.

Helping Brands Thrive Since 2004

We’ve taken the same proven marketing strategies that have generated millions in revenue for our clients and transformed them into AI-powered systems that we install directly into your business.

Your business becomes its own marketing powerhouse—automated, scalable, and built to last.

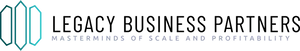

Think You Know What Your Agency or Marketing Team Is Doing?

Audit What’s Really Happening Inside Your Marketing—Before It Costs You More.

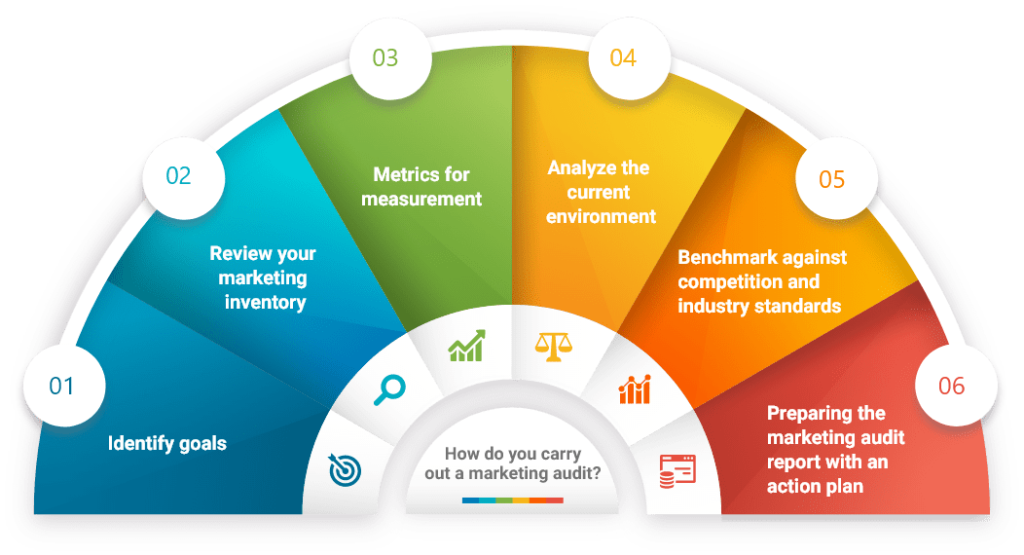

Say Goodbye to multiple Subscriptions

And Hello to the All-in-One Marketing Platform Built for Growth.

What if you could replace 6+ software subscriptions with one system—and save thousands?

Most business owners are paying $350–$1,000+ every month on tools like:

Wix or WordPress for websites

HubSpot or Zoho for CRM

Mailchimp or Constant Contact for email marketing

Calendly for appointments

And much more (see the chart for more)

The Legacy Builder Blueprint

We install your customized marketing infrastructure, systems, AI tools, and automation using our Legacy Builder Blueprint—then help you train the people and processes to run it all internally.

Legacy Building in 3 Simple Steps

Analyze

Our journey begins with a deep-dive analysis of your business operations, market position, and competitive landscape—uncovering the gaps, opportunities, and insights needed to build a strategy that drives measurable growth.

Customize

With a clear understanding of your business foundation, we move into the customization phase—where strategy meets precision. We design a tailored marketing blueprint that aligns with your unique goals and leverages the insights uncovered during our initial discovery.

Optimize

The final step we fine-tune systems for peak performance, support smart hiring and team development, and scale what works—using data-driven insights to ensure your internal marketing engine runs efficiently, grows predictably, and delivers results.

We Don’t Run Your Marketing. We Build It Into Your Business.

Experience Effortless Growth With Your First AI Employee

What is the AI Employee?

The AI Employee is a cutting-edge suite of AI-powered tools designed to automate your business processes and supercharge growth.

From handling customer inquiries and managing reviews to generating leads, and high-quality content, the AI Employee is your secret weapon for business success.

COMPANIES THAT TRUST US

Driving Sales, Amplifying Impact

George Owens

Legacy Business Partners are definitely the ones to go with when it comes to growth and marketing for your business. They're completely professional and have innovative and effective marketing strategies.

Kim Wexler

They provided excellent advice, seamless integration between social media and our website, and created campaigns geared towards our targeted audience. We look forward to our continued success with the support of LBP.

James Cart

I recently had the opportunity to receive great marketing advice from Legacy, they were able to breakdown strategies for me to implement to be able to grow my business. I am very thankful to James for all of his help.

Effortless Growth Starts Here.

Getting noticed in a crowded market is no easy feat... until now!